The semiconductor industry isn’t exactly unfamiliar with headlines touting record growth or dizzying market expansion. But every now and then, a forecast grabs your attention and simply refuses to let go. That’s what happened when I read the latest report from Futurum analyst Ray Wang. If anyone had doubts about the transformative power of AI—or the silicon that’s making it possible—this new data should put those questions to rest.

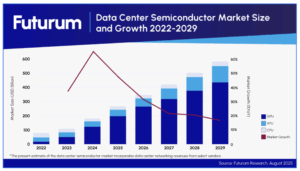

The big headline? The global data center semiconductor market is now projected to exceed $500 billion by 2029. That’s right: a cool half-trillion dollars, all thanks to the exploding demand for AI-first data centers and the chips that power them.

Let’s break down what’s fueling this surge.

The Rocket Fuel: AI’s Relentless Expansion

First, a little context. We all know the AI boom is real. Just try finding a major tech vendor who isn’t tripping over themselves to tout new “AI-powered” features, chips, or even factory builds dedicated to nothing but AI workloads. The real story, though, is what’s happening behind the scenes—in those cavernous, climate-controlled data centers springing up everywhere from Phoenix to Frankfurt to Bangalore.

According to Wang’s new study—backed by a detailed Q1 market report and insights from the Futurum platform—demand for data center silicon is accelerating at a pace that makes previous “cloud booms” look positively quaint. The report’s first graphic, a market sizing projection, tells the story at a glance: a steeply rising curve that starts at just above $200 billion in 2024 and doesn’t let up until it crosses the $500 billion mark by 2029.

That’s more than doubling in just five years.

Chart 1: Data Center Semiconductor Total Market, 2024-2029

The line starts climbing at a modest slope—and then, as if electrified, accelerates on a true hockey stick trajectory. Each year adds tens of billions in market value. The core driver? Unrelenting demand for AI compute.

The report points to sustained investments in GPU systems, custom silicon for inference and training, and next-generation processors built from the ground up for the “AI era.”

Chart 2: Segment Breakdown—Not Just GPUs Anymore

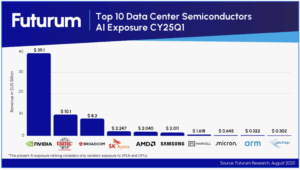

Now, it’s easy to assume this is all about GPUs, given NVIDIA’s recent media dominance. But the second key chart is a breakdown by chip segment. Sure, GPUs are capturing the lion’s share of headlines and spend, but the market is broadening.

According to Futurum’s analysis, by 2029, CPUs, memory, and networking silicon—all optimized for massive parallel AI workloads—will account for a big chunk of the total. Accelerators (think FPGAs and ASICs purpose-built for machine learning) are set to grow more than 40% CAGR over the next half-decade.

So, if you’re only watching the NVIDIA ticker, you’re missing the forest for the trees.

Follow the Money: $1.5 Trillion in AI Data Center Pledges

Beyond the market sizing, the study dives into the breathtaking capital flowing into AI infrastructure. Futurum’s research tracks over $1.5 trillion pledged for new AI data centers and so-called “AI factories” by hyperscalers, cloud giants, and even sovereign funds.

It’s a staggering sum by any measure. But as the report wisely cautions, pledged capital only counts if it’s converted into silicon actually humming away in racks. For every dollar slated for a future build, there’s a set of hurdles: supply chain shocks, power constraints, regulatory approvals, and—let’s not forget—potential shifts in the AI adoption curve itself.

A Boom Built on AI—But Not Immune to a Bust

Let’s get real about something. This entire $500 billion-plus forecast is predicated on continued, near-exponential growth in AI applications and adoption. Right now, there’s every indication the AI train isn’t slowing down. Enterprises are racing to deploy generative models, governments are launching national AI initiatives, and virtually every SaaS offer comes with “AI inside.”

But the market has seen booms go “bust” before. If the AI sector cools for any reason—regulatory pressures, plateauing enterprise demand, or even a headline-grabbing security breach—the impact on this semiconductor juggernaut would be immediate and chilling.

The Futurum report makes this clear: “While current projections point to a $500 billion market by 2029, growth is highly sensitive to the trajectory of AI adoption and infrastructure spending. Should the AI market slow, the semiconductor sector’s growth curve would almost certainly flatten.”

Sobering, but true.

Industry Winners—and the Broadening Competitive Landscape

One of the most interesting insights from Futurum’s Q1 and follow-up reports is the changing nature of competition. Just a few years ago, it was the “big three”—Intel, NVIDIA, and AMD—snagging all the mindshare and most of the margin. Today? We’re seeing a wave of new entrants and deep-pocketed vertical integrators: hyperscale cloud providers rolling their own silicon, Asian fabless chip startups, and even “chip-to-cloud” end-to-end system vendors.

If there’s a message for enterprise buyers, it’s this: more choice, but also more complexity. Staying ahead in the AI arms race means weighing not just performance and price, but also supply resilience, compatibility, and vendor lock-in risks.

So, Will $500 Billion Even Be Enough?

Here’s the kicker, and perhaps the most “Shimel” question to close on: Are these projections still too conservative?

With $1.5 trillion in new data center investments pledged, and if just half that capital spins out into new AI infrastructure in the next five years, it’s entirely possible we’ll be talking about a $600 or even $700 billion market before the decade closes. But—let me repeat—pledged dollars only matter when they become actual, working, shovels-in-the-ground projects.

And as the industry veterans know too well, forecasts rarely unfold in a straight line. Black swan events, policy changes, or a real shake-up in underlying demand can change this calculus fast.

Final Thoughts: These Are the Times That Shape an Industry

Here at Techstrong, we’ve tracked plenty of inflection points. But the confluence of AI, cloud ambitions, and semiconductor innovation feels different—it’s bigger, faster, and, frankly, riskier than anything that’s come before.

The hockey stick growth is real. So are the challenges. But one thing’s for sure: the next five years will define a generation of winners and shake out a few casualties. For now, the $500 billion data center semiconductor market isn’t just a target—it’s the new baseline.

As always, keep your eyes on the fundamentals, your budgets flexible, and your strategy grounded in reality. These are, in every sense, interesting times.